How China's Economic Transformation Is Rewriting Global Business Strategy in 2026

China's rapid economic transformation has moved from being an extraordinary growth story to a structural force that is reshaping how global business works at every level. What began as an export-driven, low-cost manufacturing model has evolved into a diversified, innovation-led system that now influences strategy in boardrooms from New York and London to Singapore, Berlin, Johannesburg, and São Paulo. For the global audience of biznewsfeed.com, which closely tracks developments in business and markets worldwide, understanding China in 2026 is no longer optional; it is fundamental to any serious conversation about risk, opportunity, and long-term competitiveness.

This evolution is not only about GDP figures, trade balances, or investment flows. It is about the way China is quietly and relentlessly reshaping the architecture of global commerce: from supply chain design and digital infrastructure to capital markets, sustainability agendas, and the future of work. What was once labeled the "world's factory" has become a central node in global innovation, particularly in artificial intelligence, green finance, and high-value manufacturing, with consequences that reach across industries and continents.

As biznewsfeed.com continues to expand its coverage of AI and advanced technologies, global macroeconomic trends, and cross-border capital flows, one theme is increasingly clear: China is no longer simply participating in global systems-it is helping write the rules, standards, and expectations that will define business strategy through 2030 and beyond.

From Export Engine to Innovation Powerhouse

Over the past decade, China's economic model has undergone a decisive shift away from pure export manufacturing and heavy industry toward a more balanced, technology-intensive, and services-oriented structure. Domestic consumption, digital ecosystems, and high-end production now play a far greater role, while automation and AI have become embedded in large segments of the industrial base.

This transition has been guided by deliberate policy. The country's 14th Five-Year Plan and subsequent strategic documents place explicit emphasis on digital transformation, green development, and self-reliance in critical technologies. The focus on semiconductors, industrial software, advanced materials, and next-generation communications underscores Beijing's determination to reduce external vulnerabilities and move up the global value chain.

Leading enterprises such as Huawei, BYD, Tencent, Alibaba, and DJI now symbolize a China that is not merely catching up with Western innovation but actively defining new frontiers in areas ranging from 5G and cloud computing to electric vehicles and unmanned systems. Multinationals that once viewed China primarily as a manufacturing base now recognize it as a source of product concepts, digital business models, and operational best practices that can be exported back to their home markets. Executives who follow technology and competitive strategy through the technology analysis on biznewsfeed.com increasingly see China as a peer ecosystem rather than a peripheral one.

Belt and Road, Digital Silk Road, and the Geography of Influence

The Belt and Road Initiative (BRI) has matured into a structural pillar of China's global economic influence. Originally conceived as a network of ports, railways, energy pipelines, and industrial parks, the initiative has expanded into a broader framework for financial cooperation, digital connectivity, and policy coordination with more than 140 partner countries.

By 2026, the Digital Silk Road component has become particularly significant. Fiber-optic backbones, data centers, satellite systems, and smart port technologies supplied by Chinese firms are now embedded in the digital infrastructure of many emerging economies. This creates not only new trade corridors but also long-term technological dependency and standards alignment. Nations across Africa, Southeast Asia, and parts of Eastern Europe increasingly run on Chinese-built hardware, software, and logistics platforms.

For global corporations, this reshaped geography of trade and technology means that market access, compliance, and competitive positioning can no longer be assessed solely through a Western regulatory lens. Companies must understand how BRI-aligned economies operate within a Chinese-centric infrastructural framework, from customs digitization and e-payment systems to cybersecurity rules. Readers exploring cross-border integration and investment patterns in biznewsfeed.com's global and economy sections will find that BRI is now less a project and more a backbone of the emerging multipolar trading system.

Further context on this shift can be found through institutions such as the World Bank, which tracks infrastructure and development financing, and the Asian Infrastructure Investment Bank, where China plays a central role in shaping regional connectivity.

Innovation Ecosystems and the AI Advantage

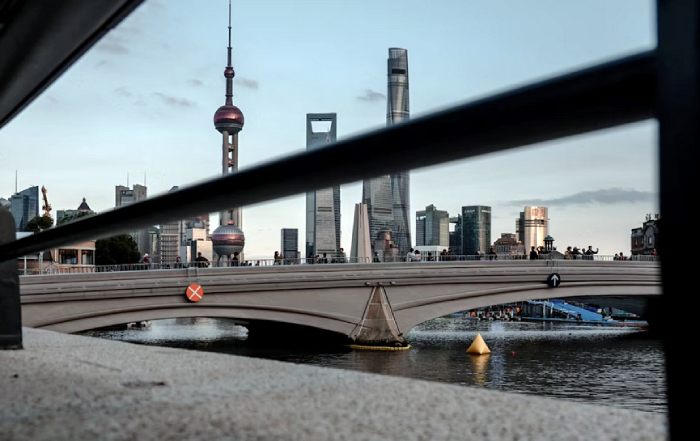

China's innovation landscape has become one of the most sophisticated and densely networked in the world. Cities like Shenzhen, Hangzhou, Beijing, and Shanghai now function as integrated hubs where universities, large technology platforms, state-backed funds, and startup ecosystems interact in real time.

The State Council's AI Development Plan and subsequent national strategies have catalyzed a surge in AI research and deployment. Companies such as Baidu, SenseTime, iFlyTek, and Megvii are deeply embedded in applications ranging from computer vision and language processing to autonomous driving and smart city management. Massive domestic datasets, combined with a relatively permissive environment for experimentation in sectors such as mobility, fintech, and public services, give China a structural advantage in scaling AI solutions.

In parallel, digital finance has advanced at extraordinary speed. Platforms operated by Ant Group, Tencent's WeBank, and other fintech innovators have made China one of the world's most dynamic testing grounds for algorithmic credit scoring, embedded finance, and real-time payments. International observers following developments through resources like the Bank for International Settlements note that Chinese pilots in areas such as central bank digital currencies and programmable money are influencing regulatory thinking globally.

For multinational enterprises, this environment encourages a shift from "sell into China" strategies toward co-innovation. Many global technology, automotive, and industrial groups now operate R&D centers in Chinese tech clusters, using them as laboratories for AI-enabled products and services that can later be rolled out worldwide. Detailed coverage in the AI and technology sections of biznewsfeed.com reflects how this co-innovation model is becoming central to long-term competitiveness.

Supply Chains, Resilience, and Strategic Interdependence

The pandemic years and subsequent geopolitical tensions exposed the fragility of hyper-concentrated supply chains. In response, many companies embraced a "China plus one" or even "China plus many" approach, diversifying production into Southeast Asia, India, Eastern Europe, and Mexico. Yet despite this diversification, China remains the anchor for a large share of global manufacturing in electronics, automotive components, batteries, and industrial machinery.

The reality in 2026 is a complex pattern of strategic interdependence. While governments in the United States, European Union, Japan, and Australia pursue industrial policies aimed at reshoring or "friend-shoring" key capabilities, companies continue to rely on Chinese suppliers for scale, quality, and integrated logistics. High-speed rail freight links to Europe, modern ports linking Asia, Africa, and South America, and dense supplier networks in regions such as the Yangtze River Delta and the Greater Bay Area create efficiencies that are difficult to replicate.

At the same time, export controls, technology restrictions, and investment screening-particularly in advanced semiconductors, AI hardware, and dual-use technologies-have forced firms to design parallel supply architectures. Many global manufacturers now operate segmented product lines and data environments: one stack aligned with Chinese standards and regulatory expectations, and another tailored to U.S. and European frameworks.

For readers examining how this dual-track world affects margins, risk, and capital allocation, biznewsfeed.com's business and markets coverage highlights how leading companies are rebalancing their global footprints without abandoning the advantages of operating in and with China.

Financial Integration, Digital Yuan, and Capital Markets

China's financial system has continued its cautious but steady integration with global capital markets. The Shanghai and Shenzhen stock exchanges, together with Hong Kong, now form one of the largest equity ecosystems in the world, while bond markets have attracted growing allocations from sovereign wealth funds, pension managers, and global asset managers. Mechanisms such as Stock Connect and Bond Connect have simplified foreign access to onshore securities, even as capital controls remain in place.

A defining development is the ongoing rollout and internationalization of the digital yuan, or e-CNY, overseen by the People's Bank of China. Pilots in cross-border trade settlements, tourism, and B2B payments have shown how a central bank digital currency can operate at scale under tight regulatory oversight. For multinational corporations, this introduces new choices in treasury management, FX risk mitigation, and cross-border liquidity planning. It also raises strategic questions about the long-term role of the U.S. dollar and euro in trade invoicing.

Banks and corporates are increasingly experimenting with digital yuan integration in trade finance, supply chain payments, and retail applications, often in parallel with blockchain-based solutions and private stablecoins. Analysts at institutions such as the International Monetary Fund and Bank of England are monitoring these developments closely, recognizing that China's approach to digital currency could shape international norms.

For the biznewsfeed.com audience focused on banking, crypto and digital assets, and global capital flows, China's financial experimentation offers both a blueprint and a competitive challenge. Financial institutions that fail to understand these shifts risk being marginalized in future cross-border payment and settlement systems.

The Chinese Consumer as a Global Demand Engine

Perhaps the most underappreciated yet decisive factor in China's global impact is the evolution of its domestic consumer market. An expanding middle class-now numbering well over 600 million people-drives demand not only for traditional consumer goods but also for premium services in healthcare, wealth management, education, travel, and digital entertainment.

Global brands such as Nike, L'Oréal, Apple, BMW, and Starbucks have long recognized the importance of this market, but success in 2026 requires a far deeper localization strategy than in earlier years. Chinese consumers are digitally native, highly informed, and quick to reward or punish brands based on perceived authenticity, sustainability, and cultural alignment.

The dominance of platforms such as Alibaba's Tmall, JD.com, Pinduoduo, Meituan, and Douyin (operated by ByteDance) has created a unique commerce environment where live-streaming, social interaction, and AI-driven personalization are integral to purchasing decisions. Western companies entering or expanding in China must adapt to these platforms' dynamics, data expectations, and performance standards.

For executives tracking consumer behavior and digital retail innovation, the business and news sections of biznewsfeed.com increasingly treat China not as a special case but as a leading indicator of where global consumer markets are heading, from North America and Europe to Latin America and Africa.

Sustainability, Green Industrial Policy, and Climate Leadership

China's pledge to achieve carbon neutrality by 2060 has evolved into a complex but powerful industrial strategy. The country is now the world's largest producer and exporter of solar panels, wind turbines, and lithium-ion batteries, and a dominant player in electric vehicles and grid-scale storage. Companies such as CATL, BYD, and Sungrow are reshaping global cost curves in clean energy and electrified transport.

Domestic policies-ranging from emissions trading schemes and renewable portfolio standards to green credit guidelines-are pushing state-owned enterprises and private firms alike to embed sustainability into their business models. Green finance has grown rapidly, with Chinese banks and capital markets issuing substantial volumes of green bonds and sustainability-linked loans, often aligned with taxonomies recognized by international bodies such as the Climate Bonds Initiative.

Internationally, China's Green Belt and Road and related sustainability diplomacy are financing solar parks in Africa, wind farms in Latin America, and electric rail systems in Southeast Asia. This positions Chinese firms not only as suppliers of low-cost green hardware but also as long-term partners in infrastructure planning and climate adaptation.

For companies and investors seeking to align with global ESG standards while accessing growth, understanding China's green industrial policy is essential. The sustainable business coverage on biznewsfeed.com explores how Chinese technologies, capital, and regulations are influencing the global sustainability agenda and what that means for corporate strategy in Europe, North America, Asia, and beyond.

Talent, Workforce Transformation, and the Future of Jobs

China's economic rise has been underpinned by a relentless focus on education and skills. Massive investments in STEM education, vocational training, and digital literacy have produced a workforce increasingly oriented toward advanced manufacturing, software engineering, data science, and green technologies.

Universities such as Tsinghua University, Peking University, and Fudan University feature prominently in global rankings and collaborate with leading institutions across the United States, United Kingdom, Germany, and Singapore. At the same time, specialized vocational colleges and corporate training programs ensure that industrial clusters have a steady pipeline of technicians capable of operating and maintaining sophisticated automation systems.

The result is a labor market where the archetypal Chinese worker is as likely to be a robotics engineer, algorithm designer, or renewable energy specialist as a traditional factory operative. For global companies, this provides access to deep pools of technical talent but also raises competitive pressure in high-value segments.

The transformation of work in China-hybrid models, platform-based employment, and AI-augmented roles-offers a preview of how jobs may evolve globally. Readers following workforce strategy in biznewsfeed.com's jobs and business sections can see how Chinese practices in automation, upskilling, and digital HR are informing management models in Canada, Australia, France, Italy, Spain, and other advanced economies.

For additional perspective on how education and skills underpin long-term competitiveness, global executives often turn to research from the OECD and UNESCO, which highlight the structural link between human capital and economic resilience.

Entrepreneurship, Capital, and the Globalization of Chinese Startups

China's entrepreneurial ecosystem has matured into one of the world's most dynamic. Cities such as Shenzhen, Guangzhou, Chengdu, and Hangzhou host dense networks of founders, accelerators, and venture funds working at the intersection of AI, biotech, robotics, new materials, and consumer internet services.

Venture capital activity remains robust, with domestic funds such as Hillhouse Capital, Sequoia China (now operating under a new brand following global restructuring), and corporate investors from Tencent, Alibaba, and Baidu backing startups that increasingly think globally from day one. These firms are expanding into Southeast Asia, India, Africa, Latin America, and parts of Europe, often bringing with them turnkey digital infrastructure, financing, and operational know-how.

This outward push is changing competitive landscapes in fintech, logistics, e-commerce, and mobility in markets from Brazil and Mexico to Nigeria, Indonesia, and Turkey. For international investors, partnering with Chinese founders can provide access to technologies and business models that have already been battle-tested in one of the world's most demanding markets.

The founders and funding sections of biznewsfeed.com track how Chinese startups are integrating into global innovation networks and how international capital is reallocating toward or away from China in response to regulatory, geopolitical, and macroeconomic signals. Complementary insights from organizations such as the World Economic Forum further illuminate how these entrepreneurial ecosystems contribute to systemic shifts in global industry structures.

Corporate Strategy in a Chinese-Centric Global System

For multinational corporations, the cumulative effect of these trends is profound. China is no longer a single "market entry" line item on a strategic plan; it is a structural variable that shapes product design, supply architecture, capital allocation, risk management, ESG commitments, and talent strategy.

Leading global companies now treat their Chinese operations as full-fledged innovation and decision centers, not just local sales or manufacturing units. Many have adopted a "China for China and China for the world" approach, in which products and services are conceived for local consumers but designed with a view to global scalability. Data generated in China-subject to local privacy and cybersecurity laws-is increasingly used to refine AI models, user experience, and operational processes that can then inform offerings in North America, Europe, Africa, and South America.

At the same time, corporate boards must navigate an unprecedented level of geopolitical complexity. Issues such as data localization, export controls, sanctions, human rights concerns, and divergent technology standards require carefully calibrated governance frameworks. Firms are investing more heavily in scenario planning, regulatory intelligence, and multi-jurisdictional compliance, recognizing that missteps in China can have global reputational and financial consequences.

The ongoing analysis on biznewsfeed.com-across business, economy, markets, and global-reflects the reality that China is now embedded in every major strategic question facing multinational enterprises, from AI ethics and climate disclosure to digital competition and cross-border M&A.

Looking Toward 2030: Interdependence, Competition, and Shared Standards

As the world moves toward 2030, the trajectory suggests neither a clean decoupling nor a simple continuation of past globalization. Instead, what is emerging is a structured interdependence in which China, the United States, the European Union, and a rising group of influential economies-including India, Brazil, Indonesia, Saudi Arabia, South Africa, and Nigeria-co-create a more contested yet interconnected global system.

In this environment, China's role is that of a system-shaping power. Its standards in 5G, EV charging, renewable energy, digital payments, and AI governance will increasingly influence global norms, not always supplanting Western frameworks but often existing alongside them. Companies and governments that can operate fluently across these parallel systems-technological, regulatory, and cultural-will enjoy a distinct competitive advantage.

For the readers and partners of biznewsfeed.com, the key strategic question is no longer whether China will remain central to global business, but how to build organizations, portfolios, and policies that can thrive in a world where Chinese capabilities, markets, and institutions are integral to every major decision. That involves not only tracking headlines but also understanding the deeper patterns of innovation, capital, labor, and governance that define China's economic transformation.

By continuing to connect developments in AI, banking and digital finance, crypto and blockchain, sustainability, founders and funding, and global markets, biznewsfeed.com aims to provide the decision-grade insight that executives, investors, and policymakers need in this new era.

In 2026, China's economic boom is no longer just a story of rapid growth; it is a structural force redefining what it means to compete, collaborate, and create value in a deeply interconnected world. Those who understand its dynamics with clarity and nuance will be best positioned to shape the global business landscape that lies ahead.