Funding Networks Connecting Global Innovators in 2026

A New Global Capital Fabric for Innovation

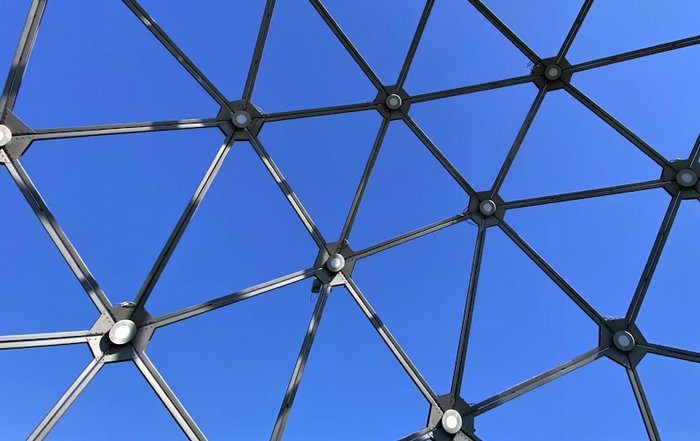

By 2026, funding networks have matured into a dense global fabric that connects founders, investors, institutions and policymakers across every major region, and for the readership of BizNewsFeed this is no longer an abstract shift but a daily operating environment that shapes how businesses are started, financed, scaled and ultimately exited. What began as a gradual diversification away from a handful of dominant hubs in Silicon Valley, London and Beijing has evolved into a truly multi-polar innovation landscape, in which capital, talent and ideas flow through overlapping regional and thematic networks that span North America, Europe, Asia-Pacific, the Middle East, Africa and Latin America. These networks are increasingly digital, data-driven and mission-aligned, with many organized around shared priorities such as climate resilience, financial inclusion, deep technology, health security and artificial intelligence.

This new architecture is visible in the way sovereign wealth funds in the Gulf partner with pension funds in Canada and the Netherlands, how accelerators in Singapore and Berlin source founders from Lagos, São Paulo, Bangkok and Johannesburg, and how corporate venture capital teams in the United States, Japan and South Korea co-invest with university spin-out funds in the United Kingdom, Germany and France. Cross-border cap tables are now the norm for high-growth ventures, global syndicates form rapidly on digital platforms, and multilateral institutions increasingly provide de-risking capital for frontier technologies in emerging markets. For executives, investors and policymakers who rely on BizNewsFeed's business and global reporting, understanding these networks has become a prerequisite for competing in markets where innovation cycles are compressing and capital can move faster than regulatory regimes can adapt. As data from institutions such as the Organisation for Economic Co-operation and Development (OECD), where readers can explore cross-border investment trends, make clear, the structure of these networks is now tightly interwoven with national competitiveness and industrial strategy.

From Local Capital Constraints to Networked Opportunity

Historically, founders in many markets were constrained by the depth of local banking systems, the sophistication of domestic investors and the risk appetite of nearby capital pools, which meant that comparable ventures in different regions faced dramatically different odds of success even when their technologies and teams were equally compelling. A fintech entrepreneur in Nairobi or a robotics researcher in Turin could build world-class products yet struggle to access the same quality of early-stage capital and advisory support available to peers in San Francisco or Boston. Over the past decade, however, the digitization of fundraising, the normalization of remote due diligence, the professionalization of global venture capital and the spread of accelerator and incubator models have fundamentally altered this equation, enabling founders to tap into international networks much earlier in their journey.

These changes have been reinforced by macroeconomic and geopolitical dynamics. Prolonged periods of low interest rates earlier in the 2020s pushed institutional investors across the United States, Europe and Asia to seek yield in private markets, while industrial policy in countries such as the United States, Germany, Japan, South Korea and Singapore prioritized strategic technologies including semiconductors, AI, quantum computing, clean energy and advanced manufacturing. Large-scale public programs in these jurisdictions were explicitly designed to crowd in private capital and build blended finance structures that could absorb higher levels of technological and regulatory risk. Readers who follow the macro backdrop on BizNewsFeed's economy and markets channels recognize that these policy moves have materially reshaped global capital flows, with innovation funding increasingly aligned to national resilience, security and sustainability objectives. External resources such as the International Monetary Fund (IMF), where leaders can examine global financial stability assessments, provide additional perspective on how these forces interact with broader economic cycles.

Venture Capital, Growth Equity and the Network Advantage

At the center of this transformation sit venture capital and growth equity firms, whose business models depend on the ability to identify, underwrite and support high-potential founders across geographies and sectors, and whose competitive edge is now defined as much by network reach and expertise as by capital size. Leading firms based in the United States, United Kingdom, Germany, France, Singapore and Hong Kong have built multi-office platforms, hired partners with deep sector specialization in areas such as AI infrastructure, climate technology, digital health, cybersecurity and fintech, and cultivated limited partners ranging from sovereign wealth funds to university endowments across North America, Europe, Asia and the Middle East. These firms operate as powerful nodes in a global information and influence network, connecting portfolio companies to regulators in Brussels and Washington, customers in Tokyo and Dubai, acquirers in New York and Shenzhen, and talent pools in Toronto, Bangalore and Tel Aviv.

For founders, membership in such a network can accelerate international expansion, unlock strategic partnerships and secure follow-on capital from blue-chip investors, while for limited partners it can enhance deal flow quality and portfolio diversification. The result is a more competitive environment for capital providers, who must differentiate not only on valuation and terms but on the credibility of their sector theses, their track record of hands-on value creation and the strength of their relationships with policymakers and large enterprises. Readers of BizNewsFeed's funding and founders sections see this shift reflected in term sheets that increasingly emphasize platform support, talent networks, regulatory navigation and go-to-market assistance. Industry data from organizations such as the National Venture Capital Association (NVCA), where professionals can review detailed market analysis, and platforms like PitchBook and Crunchbase underline how funds that can demonstrate genuine experience, authoritativeness and trustworthiness in specific domains are winning the most competitive deals.

Corporate Venture Capital and Strategic Ecosystem Building

Corporate venture capital has emerged as an equally significant force in the global funding architecture, particularly in industries where incumbents face rapid technological disruption or see strategic opportunity in partnering with nimble startups. Technology multinationals in the United States and Asia, automotive and industrial leaders in Germany, France and Japan, and major financial institutions in the United States, United Kingdom, Canada, Singapore and Australia have all expanded their CVC arms, investing in startups that can provide access to emerging technologies, new customer segments or complementary capabilities. These investments frequently involve co-investment with traditional venture funds and are often coupled with commercial agreements, joint development projects or distribution partnerships, creating integrated strategic alliances rather than purely financial positions.

Corporate investors bring substantial non-financial assets to the table, including global sales and distribution networks, manufacturing capacity, data sets, regulatory experience and brand credibility, while also offering potential exit pathways through acquisition or long-term commercial collaboration. Yet their involvement introduces governance complexities related to intellectual property rights, exclusivity provisions, competitive alignment and the preservation of startup agility. For corporate leaders in the BizNewsFeed audience, particularly those in Europe, North America and Asia-Pacific evaluating whether to expand or professionalize their CVC strategies, it has become clear that the most effective programs are embedded in broader open-innovation and ecosystem agendas rather than treated as isolated investment vehicles. Insights from platforms such as the World Economic Forum, where executives can learn more about corporate innovation and ecosystem building, reinforce the importance of aligning CVC activities with overarching strategic objectives, governance frameworks and cultural readiness to collaborate with external innovators.

Digital Platforms, Data and the Globalization of Deal Flow

The digitalization of capital formation has reduced geographic friction and broadened participation in innovation funding, enabling founders and investors to connect across borders with unprecedented speed. Equity crowdfunding portals, online syndicate platforms, digital secondary markets and tokenization initiatives have expanded access to private markets for high-net-worth individuals and, in some jurisdictions, sophisticated retail investors, while also offering new liquidity options for early shareholders and employees. Regulatory frameworks in the United States, United Kingdom, European Union, Singapore and other leading jurisdictions have gradually adapted, introducing clearer rules, investor protections and sandbox environments that allow experimentation under supervisory oversight.

These platforms generate extensive data sets on investor behavior, sector momentum, valuation trends and geographic patterns, which can be mined using advanced analytics and machine learning to identify emerging themes and under-served niches. For readers who track BizNewsFeed's technology and ai coverage, the integration of AI into these platforms is particularly significant, as algorithms are now used to filter thousands of pitches, flag anomalies, predict default risks and match investors with opportunities aligned to their preferences and risk profiles. External institutions such as The World Bank, where decision-makers can explore digital finance and inclusion initiatives, underscore that these tools are not limited to mature markets; they are increasingly central to extending credit and equity financing to small and medium-sized enterprises in Africa, South Asia, Latin America and Southeast Asia. For sophisticated investors within the BizNewsFeed community, the key challenge is to leverage the efficiency and reach of digital platforms while maintaining rigorous due diligence, governance and risk management practices that preserve trust and protect capital.

Crypto, Tokenization and Institutional-Grade Digital Assets

In parallel with traditional equity and debt channels, crypto assets and tokenization have continued to evolve from speculative phenomena into more institutionalized components of the funding stack, even as regulatory scrutiny has intensified. Tokenization of real-world assets, including private equity, real estate, infrastructure and trade finance, has gained traction in Switzerland, Singapore, the United Arab Emirates, the United States and parts of the European Union, promising enhanced liquidity, fractional ownership and 24/7 global market access. Decentralized finance (DeFi) protocols and on-chain fundraising mechanisms remain volatile and complex, yet they continue to attract technically sophisticated founders and investors, particularly in infrastructure, gaming, decentralized computing and data networks.

For the BizNewsFeed audience tracking crypto, banking and markets, the central question in 2026 is how institutional-grade digital asset infrastructure will integrate with mainstream funding networks. Regulated custodians, compliant exchanges and permissioned blockchain platforms are being developed in financial centers such as New York, London, Zurich, Singapore and Hong Kong, with banks and asset managers seeking ways to offer tokenized products that meet fiduciary and regulatory standards. Hybrid deal structures that combine traditional equity with governance or utility tokens are emerging in carefully regulated contexts. Organizations like the Bank for International Settlements (BIS), where professionals can review analysis on digital assets and tokenization, provide an authoritative lens on how central banks and regulators across North America, Europe and Asia are approaching these developments. For founders, the calculus now involves balancing the potential benefits of programmability, global liquidity and community engagement against the legal, compliance and reputational risks that still surround parts of the crypto ecosystem.

Government, Multilateral and Mission-Driven Capital in a Turbulent World

Public and mission-driven capital has become more prominent in global innovation funding, particularly as governments and multilateral institutions respond to systemic challenges such as climate change, geopolitical fragmentation, supply chain resilience and health security. The United States, European Union, United Kingdom, Japan, South Korea, Canada and Australia have all launched or expanded multi-billion-dollar programs to support strategic technologies, often combining grants, concessional loans, guarantees and equity co-investments. In parallel, development finance institutions and regional development banks in Africa, Asia and Latin America are structuring blended finance vehicles that absorb first-loss risk and crowd in private investors to projects that would otherwise be difficult to underwrite on a purely commercial basis.

For business leaders and investors who follow BizNewsFeed's economy and global coverage, these mission-driven capital pools represent both opportunity and complexity. They can dramatically increase the scale and resilience of funding for climate technologies, health innovation, digital infrastructure and inclusive finance, but they also come with stringent requirements around governance, impact measurement, procurement and compliance that can be challenging for fast-moving startups. Institutions such as the European Investment Bank (EIB) and the International Finance Corporation (IFC), where stakeholders can explore blended finance and impact structures, illustrate how public and private capital can be combined to support innovation in markets from Eastern Europe and North Africa to Southeast Asia and Latin America. Founders and investors who can navigate these structures, align their business models with policy priorities and credibly demonstrate outcomes are increasingly differentiated in competitive funding processes.

AI as the Intelligence Layer of Modern Funding Networks

Artificial intelligence now plays a dual role in the global funding ecosystem: it is both a primary target of capital and a core tool for how that capital is allocated. Leading venture firms, private equity houses, banks and corporate development teams in the United States, Europe and Asia deploy AI systems to ingest and analyze vast volumes of structured and unstructured data, ranging from financial statements and patent filings to hiring patterns, academic publications, regulatory updates and social signals. These tools support opportunity sourcing, risk assessment, portfolio monitoring and scenario planning, enabling investors to identify emerging themes, detect anomalies and respond more quickly to market shifts.

For readers of BizNewsFeed who follow developments in ai, technology and jobs, this intelligence layer has direct implications for skills, organizational design and governance. New roles are emerging at the intersection of data science, sector expertise and investment judgment, while boards and regulators in the United States, United Kingdom, European Union and Asia-Pacific are beginning to scrutinize how algorithmic tools are used in credit and investment decisions. Organizations such as McKinsey & Company, where executives can learn more about AI's impact on financial services and capital markets, highlight that firms combining human expertise with AI-driven insights tend to outperform peers in volatile environments. At the same time, the responsible use of AI in funding networks requires robust data governance, transparency around model assumptions, and careful monitoring to avoid embedding bias or amplifying herd behavior, particularly when it affects access to capital for underrepresented founders, smaller ecosystems or emerging markets.

Cross-Regional Connectivity and Sector Convergence

One of the defining features of funding networks in 2026 is their ability to connect innovators across regions and sectors that previously operated in isolation, thereby accelerating the convergence of technologies and business models. Climate-focused investors in Scandinavia and Germany now routinely back ventures in South Africa, Brazil and India that combine fintech, data analytics and hardware to address energy access, grid management and carbon markets. Deep-tech accelerators in Japan and South Korea collaborate with research institutions in France, Italy, Canada and the United States to spin out quantum, photonics and advanced materials startups with global commercialization pathways. Fintech hubs in London, Singapore and New York partner with regulators and sandboxes in the Middle East, Africa and Southeast Asia to test cross-border payment, identity and compliance solutions.

For the global readership of BizNewsFeed, spanning the United States, United Kingdom, Germany, Canada, Australia, France, Italy, Spain, the Netherlands, Switzerland, Singapore, South Korea, Japan, South Africa, Brazil and beyond, this interconnectedness shows up in the diversity of founders, investors and markets featured in daily news coverage. Hybrid conferences, virtual accelerators and online founder communities have lowered barriers to participation for innovators in secondary and emerging cities, while universities such as MIT, Stanford University and Imperial College London, alongside leading institutions in Singapore, Seoul, Zurich and Stockholm, have deepened their global commercialization partnerships. External resources like Startup Genome, where stakeholders can explore comparative data on startup ecosystems, demonstrate that ecosystems with strong international connectivity and cross-sector collaboration consistently outperform more insular peers. For founders and investors, positioning effectively within these networks requires a nuanced understanding of both global patterns and local dynamics, as well as the ability to communicate credibly with stakeholders across cultures and regulatory environments.

Sustainable Finance, Impact and the Centrality of Trust

Sustainable finance has moved from a niche concern to a core organizing principle for many of the world's largest capital allocators, and this shift is reshaping funding networks that connect innovators in energy, mobility, agriculture, buildings, materials and inclusive finance. Pension funds, insurers and sovereign wealth funds in Europe, North America and parts of Asia increasingly require that their capital be deployed in line with net-zero commitments, biodiversity targets and social impact objectives, and they are demanding robust frameworks for measuring, reporting and verifying outcomes. This has catalyzed the growth of specialized impact funds, green and sustainability-linked bonds, transition finance instruments and blended vehicles that explicitly target measurable environmental and social performance alongside financial returns.

For the BizNewsFeed audience engaging with sustainability themes through the platform's sustainable and business sections, the practical challenge lies in reconciling ambitious goals with the realities of data quality, methodological divergence and regional regulatory differences. Organizations such as the United Nations Principles for Responsible Investment (UN PRI) and the Task Force on Climate-related Financial Disclosures (TCFD), where executives can learn more about sustainable business practices, have made progress in standardizing expectations, yet implementation still varies significantly between the United States, European Union, United Kingdom and Asia-Pacific. In this environment, trust becomes a decisive asset. Founders must demonstrate integrity and transparency in how they define, measure and communicate impact, while investors must avoid greenwashing and ensure that their capital genuinely supports the transition to more sustainable and inclusive economic models. Those organizations that consistently align words with actions, and that subject their claims to independent scrutiny, are earning privileged positions within the most influential funding networks.

Talent, Mobility and the Human Dimension of Capital Flows

Beneath the data, platforms and institutions, funding networks are ultimately shaped by people whose relationships, judgment and values determine how capital is allocated and how ecosystems evolve. In 2026, the mobility and diversity of this talent base have become key drivers of global connectivity. Investors, founders and senior operators move frequently between hubs such as San Francisco, New York, London, Berlin, Paris, Amsterdam, Singapore, Hong Kong, Dubai, Toronto, Sydney and Tel Aviv, as well as rising centers in Nairobi, Lagos, Cape Town, São Paulo, Mexico City, Bangkok and Kuala Lumpur, building personal networks that cut across continents and sectors. Remote work and hybrid collaboration have made it normal for a startup to maintain engineering teams in Poland and Vietnam, product leadership in Canada, sales operations in the United States and investors in Japan and the Middle East, coordinated through digital tools.

For readers who turn to BizNewsFeed's jobs and travel content, these shifts have concrete implications for career planning, relocation decisions and organizational design. Reports from platforms such as LinkedIn and Glassdoor, as well as analyses by the World Economic Forum and OECD, highlight intensifying competition for skilled workers in AI, cybersecurity, biotech, robotics and climate technology, which in turn influences immigration policies, education priorities and workforce strategies across North America, Europe and Asia. At the same time, the human fabric of funding networks depends on trust, reputation and shared norms that are built over years of interaction. In an environment where information is abundant and capital is increasingly commoditized, the individuals and institutions that consistently act with integrity, honor commitments and communicate transparently gain a structural advantage, as founders and co-investors gravitate toward partners who embody long-term, relationship-based thinking rather than transactional opportunism.

Strategic Implications for BizNewsFeed Readers in 2026

For the global business audience of BizNewsFeed, the maturation of funding networks that connect innovators across AI, banking, crypto, sustainability, technology and travel is reshaping strategic decision-making at every level. Competitive landscapes can change rapidly as startups in distant markets access sophisticated capital and partnerships that enable them to expand into the United States, Europe and Asia with unprecedented speed, meaning incumbents must monitor not only local rivals but also emerging players in Germany, Singapore, South Korea, Brazil, India or South Africa whose models can be adapted or transplanted. Capital allocation decisions must consider a wider array of instruments, from traditional equity and debt to tokenized assets, blended finance and sustainability-linked structures, while due diligence must extend beyond financial metrics to encompass ecosystem positioning, regulatory exposure, talent pipelines, geopolitical risk and sustainability alignment.

In this environment, information quality becomes a strategic asset, and BizNewsFeed positions itself as a trusted guide, synthesizing developments across ai, banking, business, crypto, economy, funding, global markets and technology into context-rich analysis that emphasizes experience, expertise, authoritativeness and trustworthiness. For executives, founders, investors and policymakers from the United States and Canada to the United Kingdom, Germany, France, Italy, Spain, the Netherlands, Switzerland, Singapore, Japan, South Korea, Australia, South Africa, Brazil and beyond, the ability to interpret signals from these interconnected funding networks and translate them into actionable strategies is now a core competency. Those who can navigate and contribute to these networks-grounded in rigorous analysis, ethical conduct and a long-term perspective-will be best positioned to build resilient organizations, access high-quality opportunities and shape the next chapter of the global innovation economy.